The economic fabric of the US is broken. What is clear from income and wealth data is that we are strangling the American dream. The rich are getting richer at a much faster pace than the rest of the population. There is a wealth inequality that begins to approach medieval feudal states. There are kings, tradesmen, and serfs. The serfs hope to be tradesmen, but the tradesmen will never be kings.

We are an entrepreneurial country that believes with hard work we can achieve great things. We try to be less oriented toward a philosophy that government is a safety net for everyone unlike the way Europeans view their lives. Yet our level of income disparity proves higher than most countries. The Organization for Economic Co-operation and Development (OECD) places the USA behind only Portugal, Turkey, and Mexico in Income Inequality (e.g., the distance between the wealthiest 10% and the poorest 10%). Is this a problem? Maybe. Is it troubling? Absolutely.

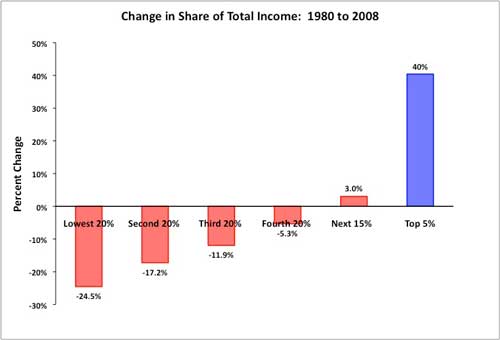

Ask yourself one question: Are you better off today than 30 years ago? NO. Our underlying problem is not visible without looking at long historical trends. Since 1980, the top 5% of households are accumulating income at the expense of the lower 95% (See Change in Share of Total Income: 1980 to 2008). When you are bemoaning how tough your children will have it, all you are doing is feeling what these statistics demonstrate. The top 5% have it all!

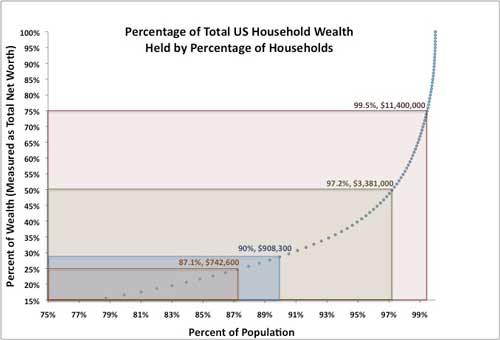

The American dream is about wealth, and this is where the real problem can be found. People always think they are not the folks at the bottom. If your total household wealth (i.e., income, stocks, retirement, house value less all your debts) is less than $742,600, you are one of 101 million households (87.1%) that make up the bottom 25% of the wealth of the US (see Percentage of Total US Household Wealth Held by Percentage of Households). If your total household wealth is more than $3,381,000, then you are one of 3.3 million households (2.8%) that control the top 50% of the wealth.

People are resilient when things are going OK (i.e., the economy is moving along). However, people start to take notice of their situation when we have an economic meltdown as we did last year and conditions suggest the end is not near. Bloomberg.com reported that same store sales for Wal-Mart Stores were down and that Home Depot is discounting spring gardening supplies, something they have historically never done. Underemployment still hovers at close to 20%, home foreclosures are at an all time high, and housing starts are near 40-year lows. People are scared and angry. They want to protect what they have or feel they deserve a largess equivalent to the income redistribution of Wall Street.

A free society cannot remain free with wealth concentrated within a sliver of the population. Trite as the expression may be: Wall Street vs. Main Street has some resonance. It shouldn't, but it does. Beating up on the big guys is emotional relief, not a solution. Financial Reform Legislation and political rhetoric will not solve income disparity.